Key Figures

Solutions

A global and integrated expertise

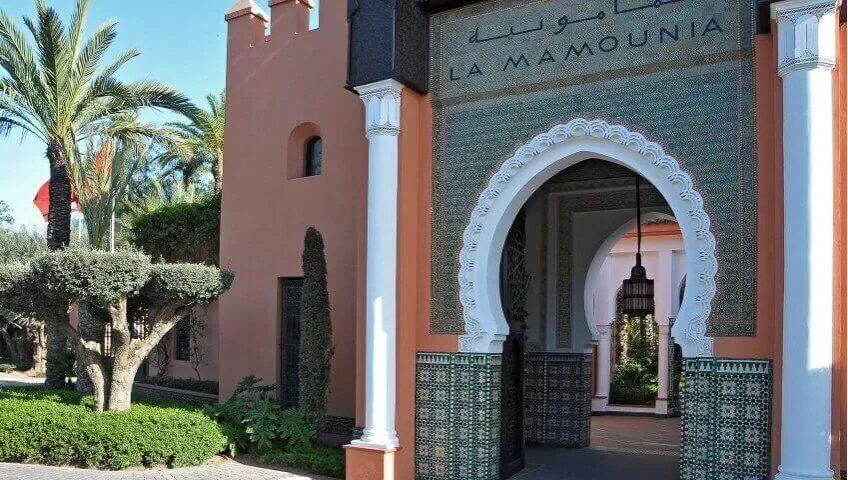

For nearly 25 years, Attijariwafa bak has been a reference advisory bank in Corporate Finance business lines and a stakeholder in a strong regional dynamic. we offer our services in all the countries of presence through our teams based in Morocco, Tunisia, Côte d'Ivoire and Dubai.

Our corporate culture is particularly characterized by the respect of the confidentiality of the processed information throughout the Group's business lines thanks to the "Chinese Walls" set in place.

We go hand in hand with our clients in their strategic operations and/or market tenders following the best international standards in terms of independence and expertise.

Mergers and Acquisitions - M&A

In Morocco and abroad, we provide support to national and multinational companies, institutional investors, public institutions and States in their strategic operations. Our services come in the form of the preparation and implementation of operations of sale or acquisition, merger, partnership, exchange of assets, or privatization.

Equity Capital Market - ECM

Both on the national and the regional level, we offer support for your projects of equity transactions on the financial markets. Our assistance includes advising and setting up your IPOs, offers for sale (OFS), offers for purchase (OFP), offers for withdrawal (OFW), etc.

In addition to our expertise and experience, we also put at the service of our clients our proximity with other leading players in their field: Placement Attijariwafa bank - network of agencies, Attijari Intermédiation and Wafa Bourse) & Investment (Wafa Gestion & Wafa Assurance).

Debt Capital Market - DCM

On behalf of public or private companies, institutional players and governments, we assist in the structuring of issues of Negotiable Debt Securities- Commercial Paper, Corporate Finance Bonds, Traditional Bonds, Subordinated Bonds, Perpetual Bonds, Convertible or redeemable bonds, etc. In addition to our expertise and experience, we also put at the service of our clients our proximity with other leading players in their field: Placement (Attijariwafa bank - Department Capital Market) & Investment (Wafa Gestion & Wafa Assurance).

Financial Structuring - Infrastructure Advisory

In Morocco and on the African continent, infrastructure projects are numerous and financing needs are growing. We assist large companies, public institutions and governments in the financial arrangements of structuring projects and in raising funds from specialized lenders (investment funds, institutional investors, banks, etc.).