Plateform Attijari Supply Chain Finance

Unlock the financial potential of your supply chain for sustainable growth.

Supply Chain Finance

Supply Chain Finance (SCF) is a financial solution that optimizes cash flow management and supply chains for both buyers and their suppliers. Through an online platform, SCF manages payments between various stakeholders. This fully digital approach ensures the security and longevity of business relationships while optimizing working capital needs for both the buyer and the supplier.

Benefits for the buyer

- Digitization of payment processes

- Control over payment deadlines

- Optimization of working capital

- Enhancement of relationships within the supplier ecosystem

- Improvement in managing operational and financial risks

Benefits for the supplier

- Digitalization of receivables processes

- Enhancement of liquidity through early payments

- Streamlining access to bank financing

- Optimization of financing costs

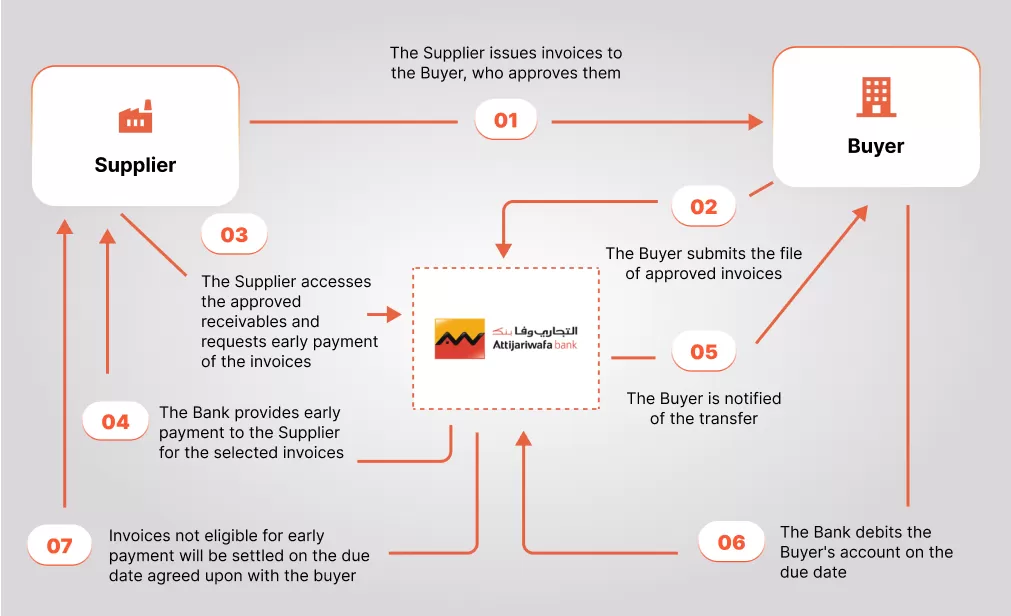

Confirming

Confirming is a financial service that enables the buyer to optimize the management of payment terms while offering suppliers the opportunity to benefit from non-recourse early payments with no guarantee requirements. This solution frees up liquidity and enhances trust within the supply chain, ensuring smooth and dynamic management of commercial transactions.

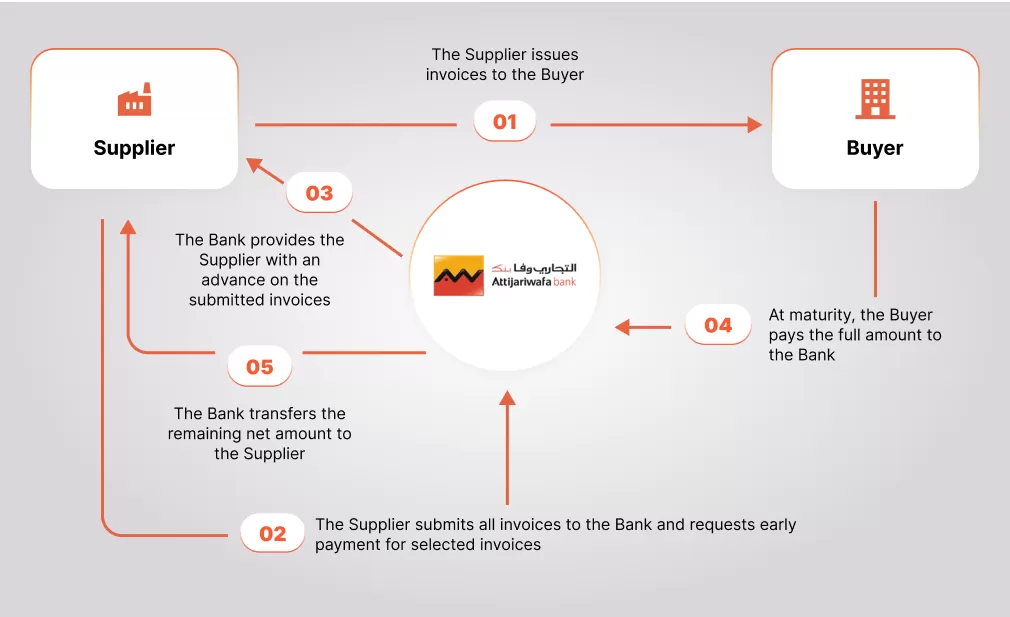

Factoring

Factoring is a financing solution that allows you to convert your receivables into immediate cash. By assigning your invoices to the bank, you receive early payment, thus strengthening your cash flow and investment capacity. This solution, which handles your collections, also offers professional receivables management, reducing the risk of non-payment and allowing you to focus on growing your business.

Our advisers are here to help you

Attijariwafa bank's Customer Relationship Center is available for any request for assistance via :

From Monday to Saturday, from 8 AM to 8 PM

@2024 All rights reserved Attijariwafa bank