FINANCIAL MARKET HEADLINES

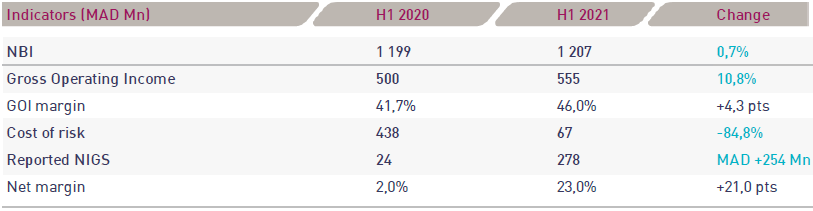

| MOROCCO | CRÉDIT DU MAROC | A NIGS of MAD 278 Mn in H1 2021 against MAD 24 Mn in H1 2020

| MOROCCO | BCP | Capital increase by partial optional conversion of DY 2020 dividends

AMMC approved, on July 29th 2021, the information prospectus relating to the increase in the par capital of Banque Centrale Populaire by optional partial conversion into shares within the limit of 50% of the dividends related to the FY 2020. The main characteristics of this transaction are as follows:

- Maximum amount of the operation: MAD 809,018,508;

- Maximum number of shares to be issued: 3,076,116 shares;

- Issue price: MAD 263;

- Nominal unit value: MAD 10;

- Issue premium: MAD 253;

- Vesting date: January 01st 2021;

- Subscription period : from August 13th to September 13th 2021 included.

| MOROCCO | MUTANDIS | Consolidated revenue up 1% in H1 2021

In Q2 2021, Mutandis posted consolidated revenue of MAD 390 Mn, up 11.5% year-on-year. In this context, the operator's consolidated revenue amounted to MAD 690 Mn in H1 2021, up 1.1% compared to H1 2020.

| MOROCCO | AFRIQUIA GAZ | Signing of a sales agreement with Sound Energy over a period of 10 years

Sound Energy has just announced that it has entered into a 10-year "Take or Pay" contract with Afriquia Gaz for the sale and purchase of liquefied natural gas (LNG). This provides for the sale by Sound Energy of a minimum of 100 million cubic meters of LNG per year to Afriquia Gaz. In addition, the signed contract also formalizes an acquisition by Afriquia Gaz of a stake of £ 2 million in the capital of Sound Energy.

| MOROCCO | M2M GROUP | Profit warning

In a profit warning, M2M Group announces a significant drop in its net results at the end of June 2021 compared to results for the same period of the previous year. This decrease is mainly explained by the unfavorable economic context marked by the lag in the progress of projects to be concluded abroad.

ECONOMIC HEADLINES

| MOROCCO | BANK LOANS | An increase of 3.7% in H1 2021

In H1 2021, the outstanding bank loans increased by 3.7% year-on-year to reach MAD 986.3 Bn.

Mortgage loans (MAD 289.8 Bn), treasury loans (MAD 227.1 Bn) and consumer loans (MAD 55.4 Bn) show respective increases of 4.4%, 9.9% and 1.6%. Meanwhile, equipment loans recorded a decline of 2.8% to settle at MAD 177.8 Bn. Finally, non-profitable loans stood to MAD 82.7 Bn, up 9.2%.

| GABON | FUNDING | IMF approved new program of $ 553 Mn over three years

The Board of Directors of the International Monetary Fund (IMF) approved, on July 28th 2021, a three-year agreement of $ 553.2 Mn (FCFA 307 Bn) for Gabon, within the framework of the Extended Credit Mechanism (MEDC). The aim is to support the implementation of the 2021-2023 economic recovery strategy in the context of the health crisis. This approval allows the immediate disbursement of approximately $ 115.3 Mn (FCFA 63.9 Bn).

Read more.